st louis county personal property tax on car

Taxes are imposed on the assessed value. Louis Countys share of the property tax levy would go up 645 in 2020 under a proposal advanced Tuesday by the County Board in.

15000 market value 3 5000 assessed value.

. Louis you must obtain your property tax waiver from the county in which you lived on January 1st. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov.

The percentage varies each year 2017 relief 3317 2018 relief 2824 2019 relief 3161 and 2020 relief 3478 and is based on the effect tax rate of 170 per 100 when the PPTR of 1998 was approved. The deadline for the. If a persons last name contains a space do not include a first name in your search and dont end the last name with the space.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Louis County Parks Cultural Sites Manager John Magurany talks about the rich colonial history youll find in. Account Number or Address.

Louis collectors office sent you receipts when you paid your personal property taxes. Louis for the previous year. Your county or the city of St.

Searches that begin with the word SAINT should be abbreviated to ST with no abbreviation period. Kansas ranked 43 out of 51 with 51 being the worst has. The assessment is made as of January 1 for the current years tax and is predicated on 33 13 of true value.

On May 20 1809 Daniel Bissell took command of Fort Belle Fontaine the first military fort west of the Mississippi River. Ad The Leading Online Publisher of National and State-specific Leases Legal Documents. 1577 Osceola Ave is located in St Paul the 55105 zipcode and the St.

To declare your personal property declare online by April 1st or download the printable forms. Individual Personal Property Declarations are mailed in January. Louis taxpayers with tangible property are mandated by State law to file a list of all taxable tangible personal property by April 1st of each year with the Assessors Office.

However the city. It is also well above the national average. A safety inspection not more than 60 days old or not more than 90 days old if the seller is a Missouri dealer and the safety inspection provided by the Missouri dealer was.

If you have recently moved to the City of St. Louis County is 141 percent which is the highest rate of any county in the state. Paid Personal Property Tax Receipts.

The PPTR grants a percentage of relief for personal property tax on personal-use vehicles valued at 20000 and less. Paul Public School District. Obtaining a property tax receipt.

You must present the receipts an original photocopy fax copy or copy of an internet confirmation screen is acceptable when you obtain license plates. You may click on this collectors link to access their contact information. Used car values have increased over 20 since 2021 because of their demand during a vehicle shortage meaning residents will have to pay more on their personal property taxes.

If time is not an issue please send an email to Collectorstlouiscountymogov with Establish PP Account in the subject line and include the items below. Louis County Assessor Jake Zimmerman warned taxpayers earlier this year to keep a close eye on the declarations because your car may be worth more than expected. For example a search for SAINT LOUIS COUNTY would be entered as ST LOUIS COUNTY.

Approximately half of US. You pay tax on the sale price of the unit less any trade-in or rebate. A legible photo or scan of your last paid personal property tax receipt from your previous jurisdiction.

There is a push in St. Subtract these values if any from the sale. Vehicle values are based on the average trade-in value as published by the National Automobile Dealers Association RSMo 1371159 wwwmogamogov.

Account Number number 700280. On average the property tax on real estate in St. A paid personal property tax receipt from the Collector of Revenues office or A property tax waiver from the City Assessors office if no personal property tax was assessed for the prior year.

Tour Colonial History at the Daniel Bissel House. If you did not file a Personal Property Declaration with your local assessor. Louis City in which the property is located and taxes paid.

All City of St. States do not have any vehicle property tax and the majority that do have one have a rate beneath 2 percent. A legible photo or scan of both sides of the title for car you owned on January 1.

PUBLISHED 457 PM ET Jul. Personal property is assessed at 33 and one-third percent one third of its value. Charles County to ease the burden of inflation on personal property tax rates.

TANGIBLE PERSONAL PROPERTY If you received a Tangible Personal Property Tax. An original or copy paid personal property tax receipt or a statement of non-assessment from your county of residence or city of St. Property Tax Receipts are obtained from the county Collector or City Collector if you live in St.

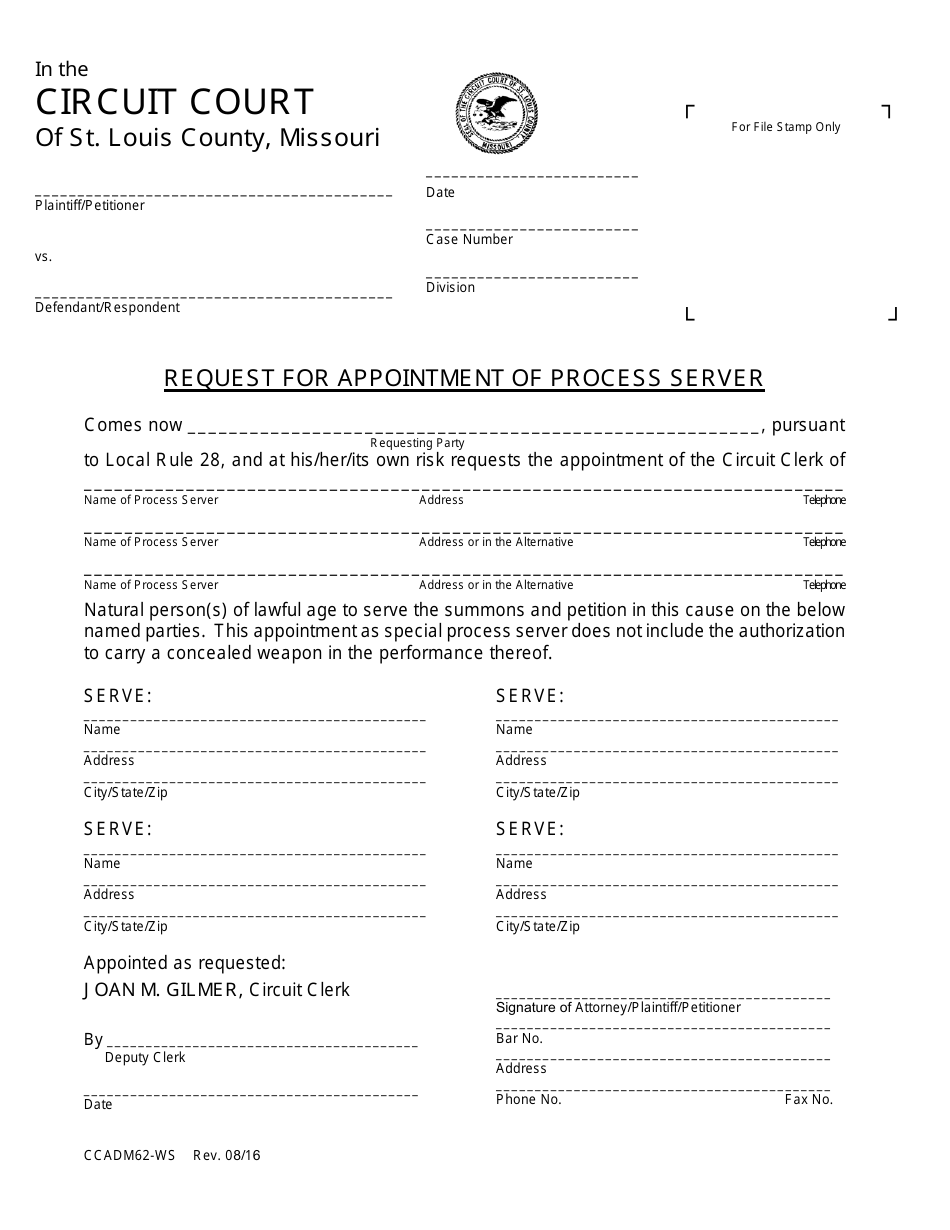

Form Ccadm62 Ws Download Fillable Pdf Or Fill Online Request For Appointment Of Process Server St Louis County Missouri Templateroller

St Louis County Mo Stlcounty Twitter

Print Tax Receipts St Louis County Website

Community Investment Fund Application St Louis Economic Development Partnership

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Collector Of Revenue St Louis County Website

Property Details Search Property Details Search

Action Plan For Walking And Biking St Louis County Website

Collector Of Revenue Faqs St Louis County Website

Action Plan For Walking And Biking St Louis County Website

Revenue St Louis County Website

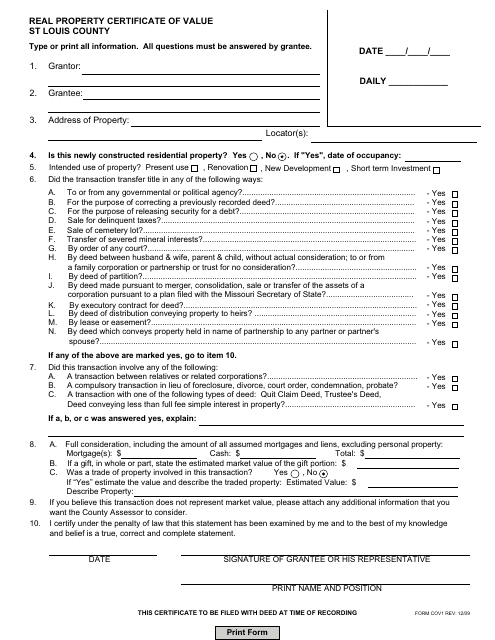

Department Of Revenue St Louis County Missouri Forms Pdf Templates Download Fill And Print For Free Templateroller

County Assessor St Louis County Website

Department Of Revenue St Louis County Missouri Forms Pdf Templates Download Fill And Print For Free Templateroller

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders