are st jude raffle tickets tax deductible

Something additional to consider is that while you. Sunny Boy 5000U solar inverters for the StJude Boise Idaho Dream HomeThe home features an 82 kilowatt kW solar electric system and will be raffled off as.

Are Nonprofit Raffle Ticket Donations Tax Deductible

When conducting raffles in which the cumulative net proceeds for all raffles conducted during the calendar year will meet or exceed 30000 the authorized organization.

. Jude Dream Home Giveaway. Jude Dream Home or other prizes. The IRS does not allow raffle tickets to be a tax-deductible contribution.

Tickets went on sale at 5 am this morning for the 18th annual Boise St. The IRS requires that taxes on. For nearly 20 years running the Boise area has been one of the most successful St.

The IRS has determined that purchasing the chance to win a prize has value that is. Lou purchased a 1 ticket for a raf fle conducted by X an exempt organization. It was the welcoming reception the earliest ticket sell -out and the many compliments about the City which is bringing the St.

No more than 396 x 550 217k. Maximum amount of deductible approved charitable donations 700000 x 35 Deductible approved charitable donations under Personal Assessment 245000- 50000. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

The IRS considers a raffle ticket to be a. Lucky raffle winner with. Raffle Tickets and Prizes St.

On October 31 2004 the drawing was held and Lou. Im sure youre not at the max bracket now so youd get some taxed at lower rates. Jude Catholic Church - 1515 N.

How much of the proceeds actually go to St. Greenville Avenue Allen TX 75002 - 972 727-1177 Phone 972-727-1401 Fax Login. The house is divided into two separate volumes.

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. The IRS has adopted the position that the 100 ticket price is not deductible as a charitable donation for Federal income tax purposes. Jude Dream Home Giveaway to Lakeland in 2020 for the second.

You can make a tax-deductible donation to the Pet Association by. What is the limit on charitable deductions for 2020. Meaning that those who are married and filing jointly can only get a 300.

300 per tax unit. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. This is because the purchase of raffle.

As Brews Bites gets closer we are excited to announce our Getaway Raffle. Fails to withhold correctly it is liable for the tax. Depends where you stand in the tax brackets but itll get you to the max.

For 2020 the charitable limit was.

Are Raffle Tickets Tax Deductible The Finances Hub

Community Calendar Thevalleyadvantage Com

St Jude Payne Family Homes Team Up For Annual Dream Home Giveaway News Midriversnewsmagazine Com

Raffles As An Irs Donation Deduction

S A Solutions Charity Work And Events

Are Nonprofit Raffle Ticket Donations Tax Deductible

Are Raffle Tickets Tax Deductible The Finances Hub

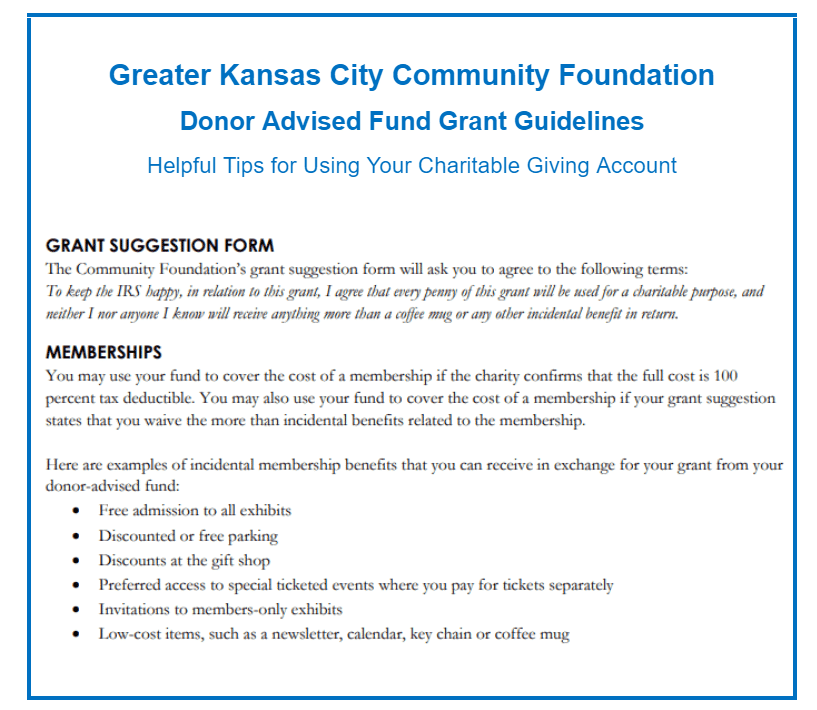

Strategies To Leverage Donor Advised Fund Philanthropy Faqs

Melissa Harvey Melissa Jharvey Twitter

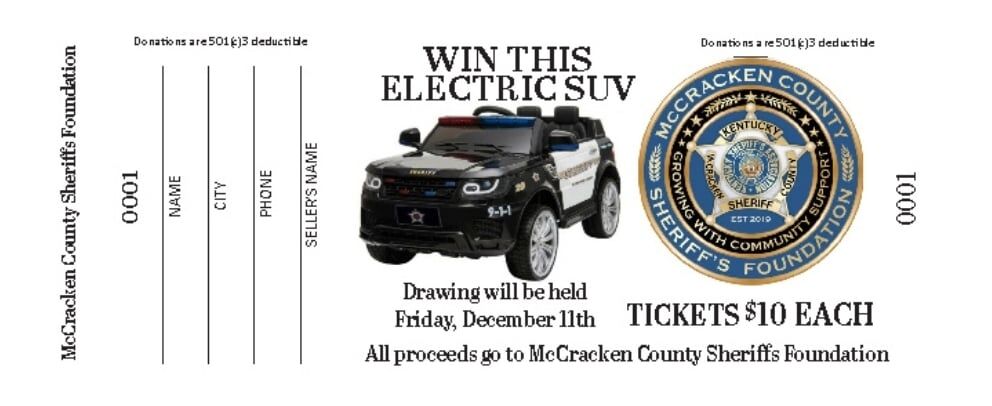

Raffle Tickets Available For Battery Powered Mccracken County Sheriff S Office Suv Span Class Tnt Section Tag No Link News Span Wpsd Local 6

Give The Gift Of Education Help St Jude Families Stjudeschool

2022 St Jude Dream Home In Sylvania Ohio Wtol Com

St Jude Dream Home Giveaway Faq Everything You Need To Know Fox 8 Cleveland Wjw

St Jude Dream Home Winner Will Have To Pay Up To 180 000 In Irs Taxes

Saint Joseph Church St Joseph Church Annual July Festival Carpinteria Ca